“This post may contain affiliate links. Please read my disclosure for more info.

The question of how to get out of debt, unfortunately, doesn’t occur to most of us until we’re knee deep in it. And it’s not usually one or two big expenses that trips us up.

It’s an accumulation over time of furniture, car payments, gifts, a weekend trip here and there…

Suddenly you realize that your life’s purpose has somehow devolved into… paying bills.

One of the worst things about living with too much debt, is that your options slowly narrow until your world consists of three things – work, home and sleep.

Living with debt not only puts your life on hold now, but each one of those monthly payments increases the time you’ll need to work before you can retire.

It’s a scary thought, and one we probably don’t realize because our society has normalized the idea of, “get it now… everyone has debt”.

Table of Contents

What’s the Rush to Get Out Of Debt?

Whether you like your job or not, the reason we spend a third of our life at it, is so one day we can call it quits and do whatever we want.

Even if becoming a millionaire isn’t your ultimate goal, taking control of your income is what’ll help you to do what you want while you’re healthy enough to actually enjoy it.

So how much do you really need to save?

Well, depending on the standard of living you expect to have, let’s try using the 4% rule. This pretty widely used estimate says, that you can safely withdraw 4% of your savings in each year of your retirement, without running out of money.

Your total savings:

- $500,000 – 4% a year is $20k.

- $1 million – 4% a year is $40k.

- $1.5 million – 4% a year is $60k.

- $2.0 million – 4% a year is $80k.

So, it’s easy to see, you’ll never be able to walk away from work completely, unless you have some serious cash saved.

One big milestone, is getting your first 100k saved. Because once you do, the magic of compound interest puts your savings into overdrive. Saving from 100k to 200k takes less time than it took to get to 100k. And getting from 200k to 300k, even less time, and so on.

The key is getting started. If it takes two decades to save the first 100k because you’re stuck in debt, that’s a big problem.

Whether it’s car payments, furniture payments, a high mortgage – if you can’t afford to put away a minimum of 10% of each paycheck, before paying any bills, that’s a red flag that debt is a problem.

And without a plan to change it, it’ll get worse each year.

Take a Step Back and Understand How You Got Here

If debt is a real problem for you, then understanding how you got here might provide some motivation to reverse course.

Granted, we do pay for a lot of things – cable TV, cell phones, wifi etc, that society considers “necessary” that weren’t even around a generation ago.

But there’s another way debt sneaks up on you…

Spend a while browsing through your Facebook feed, and there’s a good chance you’ll come away wondering what’s wrong with your life.

- One friend is lounging on a beach in Mexico.

- Somebody else is checking in from dinner and drinks at a nice restaurant, or a concert or sporting event.

- Another friend is anchored in the bay on a beautiful afternoon.

See the pattern?

We’re only seeing the highlights. We have no idea how our friend paid for her vacation, or dinner, or the concert. For all we know, they could be in debt up to their eyeballs.

But by seeing little snippets of everyone’s life – only the good parts of course, it’s easy to be convinced that something’s missing from our life.

FOMO is powerful when we start fixating on everyone around us, because it keeps us reaching for things without any real sense of direction. So much so, that according to CNBC, 40% of citizens can’t cover even a $400 emergency.

How about you?

Do you find yourself spending money for things you don’t have the cash for, because it seems like you’re “supposed” to have them?

Or do you feel inadequate because other people own certain things and you don’t?

What Will it Take to Get Out of Debt?

Oprah Winfrey once said,

“The people who get what they want, tend to be the ones who know what they want”.

And I might add…

“and make the choices each day to move in that direction”.

By “knowing what they want”, she was referring to longer term goals. Something you want to see materialize in your life – more than anything else – within the next several years.

Working to pay bills is urgent. but what’s important to you?

The motivation to get out of debt, and stay that way, is gonna take more than throwing money at your Visa bill.

Here’s an example of a goal that’ll help eliminate debt:

Suppose you and your partner take a vacation to Charleston, South Carolina. You’re planning to get married in two years, and you both love Charleston so much, that you’d like to start your life together there.

But right now, you each owe several thousand dollars in credit card debt. You’re paying a student loan too, and you each have car payments.

But now you have a common goal. Something you both want more than anything else.

Now when you browse through your Facebook feed, and see your friend on the beach in Mexico, or your neighbors dining out for the third time this month, it doesn’t bother you.

Those things are nice, but you’re not tempted now, because you have your own goal. Your long-term goal to move to Charleston is now your north star, that’ll guide every spending decision for the next couple years.

It’s easier now, to say no thanks to the things that people around you are spending money on, but for now, aren’t right for you.

You know what you want, and your choices each day are easier because you know why you’re making them.

Where do you want to be in 3 to 5 years?

- In another job? Maybe one that requires more training?

- In another home?

- Retired?

- Debt free with XX dollars saved?

- Finally launch that side business you’ve been kicking around?

It’s urgent to get up and go to work each day. But it’s important to have a reason. Something that you yourself want, and are working towards. That’s where the clarity comes from when you’re faced with 1001 things all competing for your paycheck.

Step 1 - Getting it on Paper (Or Online)

So now, we have a good idea of what got us into debt. And we know that time is critical. If we spend the next decade living paycheck to paycheck, it’s gonna seriously affect our life later.

But like any journey, we need a plan to get from point A (now), to point B (debt free).

We need to know how much money is coming in, and exactly where it’s going.

We need a budget.

But it doesn’t need to be complicated. Here’s a couple ways to get started:

You can pick up a notebook for a few dollars, and write down the categories of your expenses, like home expenses, food, utilities, clothing etc. Then grab your bank statement, and copy each expense to a category. Once you account for everything you’ve spent for the month, compare it to your income.

An easier way is to use a budget template. Your template will have the categories already listed so you’ll just need to fill in your monthly expenses.

A template will speed up the process. It’ll also make it easy to compare months to see where you’re making progress, and identify areas you want to target.

Here are 10 Free Budget Templates you can take a look at and download whichever one you like.

Got your categories listed?

Good, now you’ll need your bank statement. You want to capture every nickel you’re spending, and put it into a category.

Don’t be surprised, if your expenses are higher than your income. It happens. But we’re gonna start reversing that.

Step 2 - Schedule Regular Budget Meetings

Now that you can see where your money’s going, you’ll need to make some decisions on where you might cut back, and what your priorities are.

So if this is gonna affect your lifestyle and your spending, you want to have buy-in from whoever else spends money.

You want to agree that from now on, things will be different.

Not worse, just different.

If you live by yourself, this will be an easy meeting.

But whether it’s a party of one or two, make a point of sitting down once a week for a 15-20 minute low-pressure “money meeting”.

Your weekly money meeting is just a time to strategize together about things like:

- Did we stay within our budget this week?

- Are our budgeted amounts working?

- What’s happening next week? Any work lunches you need to plan for, or birthdays you’ll need a gift for? Does the car need an oil change?

Having this short, low-pressure get together reinforces the fact that you’re heading in the same direction, and there are no surprises to throw you off-track.

Step 3 - Start an Emergency Fund

This is a simple concept that prevents so many people from getting out of debt:

Your checking account should be for budgeted money, and maybe a small buffer. You need a separate account for emergencies.

The whole point of writing and using a budget is to have a predictable flow of money from your checking account. Suddenly throwing a $900 car repair into your carefully planned budget will probably:

- Cause you to skip a bill or two, and spend every last dime trying to pay for the emergency.

- Or put you deeper into debt by paying for it on a credit card.

And it’s why so many people throw up their hands in frustration and conclude that “budgeting doesn’t work“.

I thought for years, that I couldn’t afford to have an emergency fund, but that’s living with a scarcity mindset. Pinching pennies for this month, without regard for the bigger picture is a paycheck to paycheck trap .

You can’t afford not to have an emergency fund.

If you’re really struggling with debt right now, forget about the recommended 3 to 6 months of expenses. But do everything in your power to get $1000 into a separate account.

Sell stuff, work overtime, cut back on hobbies, entertainment and whatever it takes to throw every dime you can into a dedicated emergency account.

Whether it’s a brake job on the car, a medical expense or some other emergency – the next one will come when you least expect it. And the last thing you want to do, especially now, is to add to your debt.

I found a way to build an emergency fund in very small increments, and have it done automatically. I barely notice the contributions, and as of today I have $931.04 in it.

It costs me $2.99 per month, but here’s why it’s been a lifesaver:

We have two cars, and neither of them are new. My emergency fund has paid for about 4 repairs over the last year, and every cent has come from my emergency fund.

Whenever I need to withdraw money from it, the automatic transfers ensure that I have enough for the next emergency.

If it sounds like it’ll help you, here’s how I set it up in about five minutes.

Most emergencies are less than $1000, so getting that into a separate account is huge.

If you want to get out of debt steadily, without unexpected emergencies wiping out your progress, you absolutely need to be able to pay cash for them.

You can do this!

Related: How to Make $1000 Fast

Step 4 - Start Attacking Your Debt

So we know where our money’s going, and we’ve started an emergency fund. Now we want to start crushing our debt.

We need a plan.

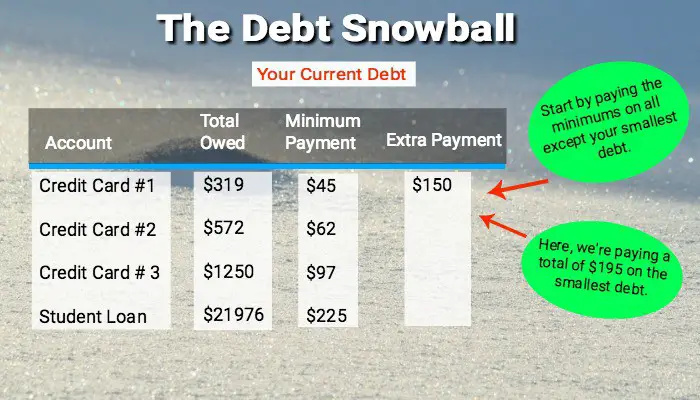

Two popular get out of debt methods, are the debt snowball and the debt avalanche.

They’re similar, in that you pay minimum payments on each of your debts except one. On that account, you pay every penny you can, until you eliminate it.

Here’s the difference:

The Debt Snowball

You’d pay the minimum payment on each account except the one with the smallest balance. On the account with the smallest balance, you pay the minimum, plus every extra dollar you can, until you eliminate it.

The debt snowball’s advantage is that you get quick wins by paying off smaller accounts faster. It’s a psychological boost, and a motivator.

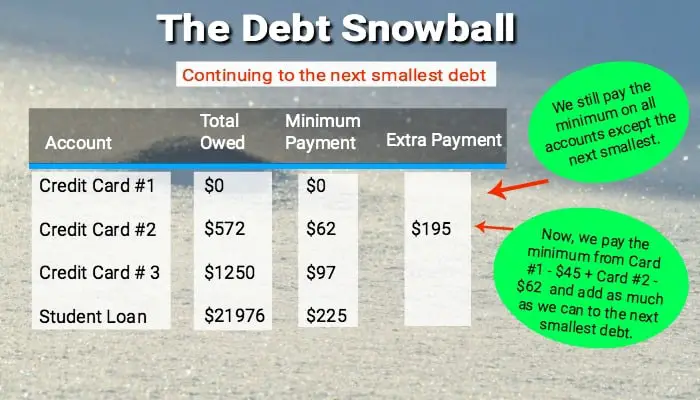

Then once we eliminate the smallest debt, we focus on the next smallest:

The Debt Avalanche:

The debt avalanche uses the same systematic approach, except that you’d pay the minimum on each account except the one with the highest interest rate. For that one, you’d pay every dollar you can, until you eliminate it.

Then you’d continue to pay the minimum payment on each account except the one with the next highest rate. And you’d continue this pattern until you get out of debt completely.

It’s possible that overall, the debt avalanche may save you some money in interest payments.

But I still prefer the debt snowball, because to me, it’s more motivating to see accounts wiped clean faster. There’s a psychological boost that encourages you to want to sacrifice even more.

Whichever method you use, try to remember:

- Be consistent. Keep hammering away.

- Have weekly budget meetings – even if you live alone, to make sure you and your partner, or you alone are on course.

- You don’t need to wait until the due date to pay a bill. If you get a bonus or a gift, go online and make a payment right away. It’ll remove the temptation to spend that money, and you’ll reduce the interest you’re paying.

Use Your Budget as a Tool

Once you open your emergency fund, and start either the debt snowball or debt avalanche, you might find you’re only able to pay a small amount towards debt each month.

Don’t be discouraged.

Each month you use your budget, it’ll become more useful. You’ll see patterns of where most of your money is going, and you can work on lowering one expense at a time.

And as you do, you can speed up your debt payoff.

Here’s some of the low-hanging fruit – some of the expenses that drain most budgets:

- Add up everything you spent on food last month. Groceries, take-out, restaurants, work lunches. The total might surprise you. But here’s a way you might save several hundred dollars pretty quickly.

- Do you pay for cable TV? If you do, you’re paying for dozens of channels you never watch, and are also paying endless rental fees for their equipment. Here are 20 cable alternatives that’ll save hundreds of dollars.

- Look for patterns with your spending. When does it seem like you spend the most? On the weekends maybe?

- Are there any habits you might be able to cut back on temporarily, like paying for the gym?

- Do most of your payments fall in one half of the month? Try changing some of the due dates.

Being consistent is the key.

Don’t worry that your first month or two of using your budget shows you’re living way beyond your means. That’s exactly what it’s for. To give you the information you need to make things better.

Of course, the other way to eliminate debt, in addition to cutting back, is to bring in more money.

Here are 20 side hustles you can try that don’t require experience or a big investment to get started.

The Real Problem Might Not be Money

The biggest lesson I learned while climbing out of debt, is that I was focusing on the wrong issue. It seemed like we had a money problem, but our shortage of money was really a symptom of other problems.

- We had no plan. I was contributing to a 401k, but we had no emergency fund, and no goal that would have motivated us to manage our money closely. We were working to pay bills.

- We watched friends and neighbors driving new mini-vans every few years, going to Disney and putting pools in. And when you don’t have a plan of your own, it’s easy to start reaching for what everyone else wants.

- I no longer enjoyed the work I was doing, but the salary and benefits were good. I should have been picking up other skills that would have enabled me to do something I enjoyed more – and possibly made more money.

- Struggling with debt is frustrating, and it’s possible to assume a hopeless attitude and just sit in front of the TV each night. But whatever your situation, it’s not hopeless. The first step is just getting it down on paper. And then making a plan.

Getting out of debt isn’t always a matter of cutting back and doing without, or making more money to service your increasing debt.

It’s also about having a direction. A plan for your next several years. Because once you do, spending decisions suddenly become easier.

What to Do Once You Pay Off Your Debt

When you finally make that last debt payment, it’s time to celebrate. Cheaply.

By eliminating those monthly payments, you’ve opened up a lot more possibilities in your life.

- If you want to transition to another career, you’ll be able to afford some training.

- You can actually save money and feel more secure.

- If you have a hobby, you’ll be able to spend a few bucks on it.

- When the car breaks down, it won’t ruin your week. Or your month.

Once you’re done celebrating, there’s a few things you’ll want to do now that you’re debt free:

1. Consider setting up sinking funds

Using sinking funds is a simple budgeting trick that not many people use, but can be a key to helping you escape paycheck to paycheck life.

Sinking funds are accounts you setup for two different types of expenses:

- Irregular expenses like quarterly bills or kid’s school expenses. The kinds of expenses that always surprise you and interfere with your budget.

- Things you want to buy, like a new couch, a home improvement, a vacation, or your next car.

A sinking fund isn’t an emergency fund. You still want to maintain an emergency fund for true emergencies that need to be fixed immediately.

But sinking funds will take the surprises out of your monthly budget and help you to avoid debt by paying cash for the things you want.

Here’s how to setup your own sinking funds.

2. Get a credit report

Chances are, there’s some negative information in yours, especially if you were using more than 30% of your available credit.

Now you can make sure it’s correct. Most credit reporting agencies (including AnnualCreditReport) will give you a summary, but not your FICA score unless you pay for it.

I’ve been using Credit Sesame because they’ll give you the same summary as Annual Credit report, but they’ll also give you your FICA score for free. There’s no charge at all to use them, and it’s a secure service.

3. Keep Building Your Emergency Fund

When you get to the point where you have 3 to 6 months of expenses saved, then you can start ramping up your retirement savings.

Remember, getting that first 100k is the hardest, but after that…you’ll see it grow quicker.

Dave Ramsey has a simple plan called the 7 Baby Steps that guide you through building your emergency fund, to budgeting, paying off debt, and beginning to build wealth.

Here’s how we were able to complete the 7 Baby Steps.

4. Tracking Your Net Worth is Key

Getting out from under the burden of consumer debt is such a relief that you’ll want to avoid slipping into it again. The best way to see immediately whether you’re trending up or down overall, is to track your net worth.

Net worth is just the sum of everything you own, minus everything you owe. If it’s gone down this month, you’ll want to look further to see why.

Maybe you increased a credit card balance, or withdrew cash, or maybe the balance of your retirement savings decreased.

Rather than spending an hour checking various accounts, a free app like Personal Capital can show your net worth – the combined balance of all your accounts on one screen.

Personal Capital has other benefits too, like budgeting and investment tracking, but the ability to see your net worth any time, for free, is a great tool to have.

5. Have a Personal Goal to Focus On

Having a personal goal, or a joint goal with your partner is a key to developing the mindset you’ll need to get out of debt.

Spending decisions come at us multiple times a day. So your decision process can’t be:

“Do I have the money in my account today?“

It needs to be:

“Does this make sense for me at this point? Even if my debt is paid off, is this contributing to the life I want?“

You’ll always see the highlights of your friend’s lives in your Facebook feed. Do you deserve that Mexican vacation, or the concert tickets, or the dinners out?

Of course you do.

But what you really deserve is to have a plan – something you, or you and your partner are focused on.

Putting in the work to become debt free will probably change your opinion of consumer debt. It’s likely you’ll stop looking at debt as a solution to problems, and start seeing it as a problem to be avoided.

Committing yourself to a debt reduction plan doesn’t mean you’ll sacrifice every joy in life from now on. It means you’re shifting your outlook from short-term, monthly bill paying, to the bigger picture. One that’s focused on those few things most important to you. Maybe you’ll make temporary sacrifices, but overall, you’ll have less regrets.

How about you?

Are you in the process of reducing debt? Has anything worked well for you?