“This post may contain affiliate links. Please read my disclosure for more info.

If there’s always more month than money in your world, then using a budget could be the answer to moving past paycheck to paycheck life.

But less than half of Americans actually use a budget. One reason is that many of us misunderstand how to budget.

A budget seems like just a listing of your income divided among all your expenses, right?

That’s what I thought, and I have a dozen old Excel spreadsheets that I started and gave up on.

I was frustrated that my income never measured up to my expenses, and even when I tweaked everything so that they did, something unexpected, like a car repair would blow it all up.

Learning how to budget the right way, was huge for me. And it can be for you too.

So here we’ll go over how to setup your own simple budget that’ll enable you too, to actually start saving each month. One where those car repairs won’t phase you a bit.

Table of Contents

Why Do You Need a Budget?

Budgets aren’t just about crunching numbers each month and then depriving yourself. If you think of a budget that way, who’d ever want to use one?

Sure, you need to add up your expenses each month, but there’s a higher purpose. Budgets are about money, but they’re also about time.

We all have a finite amount of cash each month, so we need to make sure it’s going to the right places. But we also have a finite amount of time.

It seems like we have decades to live out our personal goals. Maybe you want to explore Italy, or sail around the Caribbean for a month. Or maybe you want to hike the Pacific Coast Trail, or restore a ’68 Mustang. Or raise a family.

You can do all of that. But not if you’re living paycheck to paycheck.

When you’re not clear on what you can say yes to, and what you should pass on, most people tend to say yes to too many things. Too much rent or mortgage, too much on food, cable TV, cars, entertainment, and so on.

When you’re cash strapped, your choices in life shrink until you’re literally working to pay bills. And all those big goals drift a little further away each month.

The most expressed regret of people late in life is that they failed to live the life they originally wanted. Money plays a big part in that. When you don’t control what you spend, your choices in life shrink.

So using a budget isn’t just an exercise in crunching numbers. It’s a tool that forces you to decide what to say no to, so you can say yes to the things that matter.

How to Budget – What Do I Need to Start?

For a budget to work, it needs to account for every dollar you’re spending. Even if you’re blowing money now on things you’d like to change, you want to write down an honest accounting of every dollar spent for the last full month.

You can use a plain old notebook for this, but the only drawback is that you’ll need to rewrite your categories each month.

An easier way would be to use a budget template that has categories already listed. It’ll save you time, so you’ll only need to add your expenses. Making it easy is key, because we want to do this every month.

Here are 10 Free Budget Templates you can check out, and try whichever one works for you.

Just getting your last full month of expenses documented is a big step. It might raise an eyebrow or two over where your money is going, but before we start making target amounts, there’s one other step…

How to Budget – Step One: Determine Your Why

Forget about the numbers for a minute. Remember when we talked about the things that matter to you?

What are they? What do you want to do over the next 5 years?

- Is there a certain career goal you’d like to achieve? What would it take to be qualified?

- Are you saving for a home, or to make some improvements to yours?

- Do you have a mountain of debt that’s preventing you from moving ahead?

- Is there some education or training you’d like to complete?

- Are there places you’ve always wanted to travel to?

Grab your notebook and write down your goal. This is your why. This is where the motivation will come from when you’re deciding whether you can afford that second dinner out in two weeks.

Remember, it’s not just money that’s limited. Time is too. Put your dreams and goals front and center.

How to Budget – Step Two: Get it on Paper

Ok, now’s when we start crunching numbers, but no worries. It’s pretty painless.

There’s a variety of ways to budget:

- There’s the 50/20/30 budget, where you assign a percentage of your income to different categories.

- There’s also the envelope method, where you put cash into envelopes dedicated to certain expenses.

Here, we’ll use a simple way to get control over every penny – the Zero-Sum budget.

The zero-sum budget just starts with your income, and assigns every penny to an ‘expense’. Right down to zero. So at the end of a pay period, you should have zero dollars left.

It’s pretty simple to do.

Once you divide your income among your categories, you’ll either be short, or you’ll have extra.

- If you’re short, you’ll begin to adjust or cut back wherever you need to.

- If you have extra, and you’re making minimum payments on consumer debt, you can apply it there.

- Or if you’ve managed to pay off your debt, wouldn’t it be nice to transfer a little extra to your emergency fund, or make an extra principle payment on your mortgage?

I like the zero-sum method because it’s easy, and it gives you full control of your income. Trying to keep a buffer in your checking account for emergencies, is a never-ending guessing game.

And if you find an extra $100 in your account, it’s really easy to blow it on dinner out or a trip to Target. If there’s something specific you want, it’s better to create a saving category for it and then pay cash.

With the zero sum budget, every dollar is assigned a job, right down to zero.

OK, ready to take control?

Grab your notebook and a pencil, or you can grab one of our Free budget templates.

The first expense is ‘Savings’.

It may seem odd to treat savings as an expense, but here’s why:

- Other than hitting the lottery, paying yourself first is the only way you’ll ever move from paycheck to paycheck, to saving and investing.

- Your budget needs to be predictable every month, so you can plan your life. And the only way to make your budget predictable is to pay for emergencies from a separate account. So initially, your savings category will be money funneled into your emergency fund until you have enough.

Here’s an example of the huge impact of paying yourself first: 3 Simple Keys for Anyone to Become a Millionaire

Next, comes fixed living expenses. The ones that don’t vary each month:

- Mortgage or Rent.

- Insurance payments (car, life, health)

- Loan payments (student, personal, auto)

- Phone

Next, are regular expenses that may vary a bit from month to month:

- Food (Groceries, restaurants, take-out, work lunches)

- Household items

- Clothing

- Personal expenses like haircuts.

- Entertainment (movies, day trips, etc)

- Certain utilities

Total the amounts you’ve spent for each expense category, and put the totals in the Actual column. The Budgeted column will be our target amount. For instance, maybe your actual food expense was $800, but for next month we want to budget $600.

For some expenses (like Food) you’ll need to add multiple instances, then add the total in the Actual column. For instance, maybe you had 4 grocery store trips, 2 restaurant trips, 3 take-out orders, and 10 work lunches. That’s your Food total.

How to Budget – Step Three: Make Adjustments

So how does it look?

Once you subtract your Expenses from your Income, is there anything left?

If you’re in the red by a few hundred dollars a month, you may be able find it by adjusting your expenses here:

- Food is notorious for being one of the highest monthly expenses, but has a lot of flexibility. Meal planning isn’t that difficult, and can almost always recover a few hundred per month. Here’s how we reduced our food costs almost in half.

- Personal things like clothes and haircuts can be arranged to coincide with a less expensive time of the month.

- For some utilities, like heat, try using the budget option. That’s where they total the last 12 months of usage, divide by 12, then charge that amount. They’ll rebalance it once a year. Here’s how we were able to reduce our heating and cooling costs by about 30% last year.

- And entertainment is self-explanatory. I found we were spending hundreds of dollars per month by going out every weekend with no other plan other than to get out of the house. Going out is fine, but if it’s breaking the budget, then it’s time to think up some low, or no-cost options.

If you’re really in the red – more than a few hundred dollars per month:

Don’t panic yet. Remember, our budget is telling us the truth. If we didn’t find out now, we’d find out when the next emergency hit and we couldn’t pay the mortgage. Or we’d continue to put emergencies on credit cards, and live paycheck to paycheck for the the next three decades.

Knowing your situation is the first step. Now we can do something about it.

The choices may be a little tougher if your income is a lot lower (lets say $500-$600) than your expenses each month.

- What percentage of your monthly take home pay, is your rent or mortgage? If it’s more than around 25% can you lower that by taking in a roommate? Or moving to a cheaper place? There’s no shame in taking a temporary step back, in order to start taking permanent steps ahead.

- Is credit card debt a big part of your expenses? If you have several accounts, you may be able to consolidate them into one lower interest card. As long as you vow not to charge anything else on it.

- Another option is to call your credit card companies and just ask for a lower rate. They don’t have to oblige, but if you pay regularly, that’ll help your chances. Or if you agree to an automated payment they may lower it.

- Are you financing a new car? What percentage of your income is it? I know, it’s nice having a new car, but if you’re living paycheck to paycheck and have no emergency fund or savings – then you can’t afford it.

- Make sure to examine your habits. Do you eat out twice a week, and order out a few more times? Examine your checking account statement and identify patterns.

Another option to close the gap, is to bring in more income. Even if you’re already working full-time, here are some online options you can use to earn money from home:

- 28 Work From Home Jobs That’ll Make You Ditch Your Commute

- 20 Side Hustles to Earn an Extra $100 a Day

The magical thing about a budget, is that once you use it for a few months, you’ll see the answers. Maybe you’re spending $900 a month on food for a family of 3 (like I was). Maybe your social life is costing a fortune, or your rent, your mortgage or car payment approaches half of your take home pay.

How to Budget – Tips for Success

Agreeing on the big decisions makes the smaller ones easier.

One way to head off arguments about day to day spending, is to talk about long-term goals. If you can agree on a 5 year and a 1 year goal, then it’s easier to see eye-to-eye on spending habits.

Make it a Team Effort

Usually, one person tends to take on the task of managing the budget. Like, looking over the past week, and updating the numbers. That’s Ok, but it’s still a good idea to have a weekly sit-down with your partner.

Having a short weekly ‘budget check-in’ helps both parties. The budget keeper can avoid the feeling of overwhelm, and having to be the gatekeeper. And if the other person is better informed, there should be less misunderstandings.

Making it a Habit

Going to the gym once a month might be fun, but it won’t do much for your health. And sitting down with your budget once a month is probably going to be an exercise in frustration.

Things change from week to week – maybe this week you’ll need to pay for a work lunch, or take the car for an oil change. Next week you might need to buy someone a gift. It’s best to be able to react and adjust right away.

Once you’re using your budget, pick a regularly scheduled time, (like a weekend morning) when you have about 20 minutes.

Have these things:

- Your planner, or scheduler to look at the coming week.

- Access to your online account, or your recent statement.

- Your budget.

This shouldn’t be a stressful meeting. It’s a positive way to make sure you’re on course and prepared for the coming week.

Schedule Your Expenses

Many creditors are willing to move your due date to a date during the month when it’s more convenient for you. So if you find that most of your bills come due in the same two-week period, try making a call or two and ask if they’re willing to adjust the date.

The same goes for spending. It may help to plan your meals and then schedule your grocery shopping during a certain week.

How to Budget – Answers to Common Questions

What if you’re struggling to eliminate debt? Should you still pay yourself first, or focus on debt?

One of the biggest reasons budgets fail, is when emergencies happen. If you need to pay for emergencies with money already budgeted for something else, or charge it, then you’re prolonging your paycheck to paycheck lifestyle.

Remember, a budget is for expenses you know you’ll have. The predictable ones. Not emergencies. So even if you’re struggling to pay off debt, your budget needs to have a category for emergency fund saving.

How much should you budget for emergencies?

Ideally, you’d want about 6 months salary in an emergency fund. But if you’re struggling to eliminate debt, try to get just $1000 saved. That’s enough to pay for most emergencies, so you’ll avoid adding to your debt or using budgeted money.

Once you reach $1000, then refocus on eliminating debt. If you need to dip into your emergency fund, try your best to gradually build it back. When you finally eliminate credit card or student loan debt, then you can focus on saving – first a 6 month emergency fund, then retirement, college funds or other savings.

Is it better to budget using cash (like the envelope system) or use a credit card?

Some people believe that placing pre-determined amounts of cash in envelopes will help them stick to their budget. That may work for things like groceries, haircuts, clothing, or pocket money.

I personally prefer to use my debit card for almost everything. I can track everything through my online account, and I don’t need to bother going to the bank to get cash.

Also, if you run into a problem with a merchant, sometimes it can help having the credit card company as an ally.

Should dinners out be budgeted as entertainment, or food?

In my opinion, dinners out should be counted as food. Here’s why:

Going out with friends on a planned activity could be considered entertainment. But most dinners out are probably just you, or you and your family. And many of those dinners are last minute decisions because there’s nothing to make at home, or you’re just not in the mood to make dinner.

When you total the amount spent on groceries, dinners out, take-out orders, work lunches, and convenience stores, food becomes one of the 2 or 3 biggest monthly expenses for most people. But with some simple planning, you can usually recover several hundred dollars per month pretty quickly.

How to Budget Using Other Apps

If you’re just starting to budget your money, a good old notebook and pencil, or one of our free templates will work fine to get a grip on your finances.

But if you want to design your own budget, or you’d like to try something with a few more bells and whistles, here are a few other options:

Excel or Google Sheets

Excel and Google Sheets are similar spreadsheet apps, and are both pretty easy to to get a basic understanding of. They each have built-in budgeting templates you can use.

Choose one of their templates, or create your own spreadsheet. Then customize it with your own layout and colors like the one pictured above, or just keep it simple and lay out a few auto-totaling columns of expenses.

Cost: Google Sheets is free. If you prefer Excel, students with a .edu email address should be able to get a no-cost student license. Otherwise, a one-year subscription to Microsoft Office 365 (which includes Excel) costs $79.95.

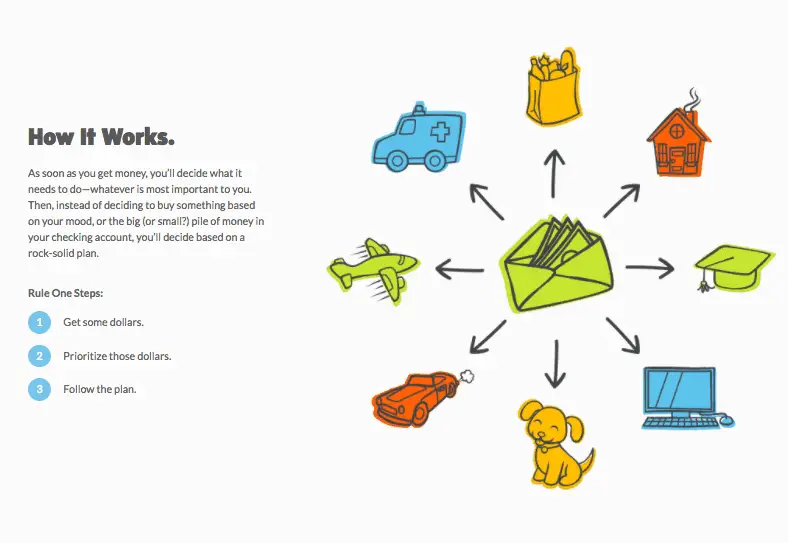

YNAB – You Need a Budget

You Need a Budget or YNAB to it’s users, is a step up from pecking your expenses into a spreadsheet. It’s designed specifically to help you stop living paycheck to paycheck. It’ll help you to pay down your debt and give you tips on how to deal with unexpected expenses. It’s clearly laid out and really user friendly.

YNAB’s overall theme is that every dollar has a job. So it won’t let you budget for money you don’t have. It’s going to force you to live on the money you actually earn.

If you happen to get in a jam, YNAB will offer advice on how you can change things to get back on track. YNAB also features an “accountability partner” to help keep you on top of things.

Cost: YNAB is free for 34 days, then $6.99 per month, billed annually at $83.99.

Note: That cost includes service & support, and online classes with a live instructor. They’re all about helping you to learn basic budgeting skills that’ll help you to start moving forward. And they guarantee a full refund if you’re not satisfied.

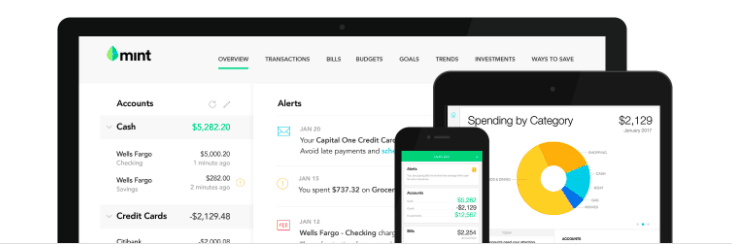

Mint

Mint is one of the most popular apps for not only budgeting, but keeping an eye on some of your other accounts.

It’s a simple, easy to use tool that’ll help you learn how to budget, track your spending, and give you insights about where your money is going. And you can use it from your laptop or your phone.

Here are the main differences between YNAB and Mint:

-

- Mint is free, and YNAB will run you $6.99 per month or $83.99/year. Or free for 1 year if you’re a student.

- YNAB focuses more on your immediate expenses – like getting through this month. It forces you to be more aware of expenses by having you enter them manually. It’s kind of an electronic notepad to track your budget.

- Mint is more about automating your finances. But it’ll still help with your budget. For instance, if you want to be notified if you’re about to go over one of your monthly categories it’ll do that.

- But you don’t have to calculate every penny. Mint will give you a quick snap-shot of your overall finances, or give you a quick summary of how your debt payoff is going without a lot of manual work.

- With YNAB, if you want to calculate your net worth, you’ll need to do it manually. It’s designed with less automation to encourage you to really drill down and evaluate every expense.

Mint and YNAB are both powerful apps, very popular, and will work well depending on your personal situation.

Cost: Mint is FREE.

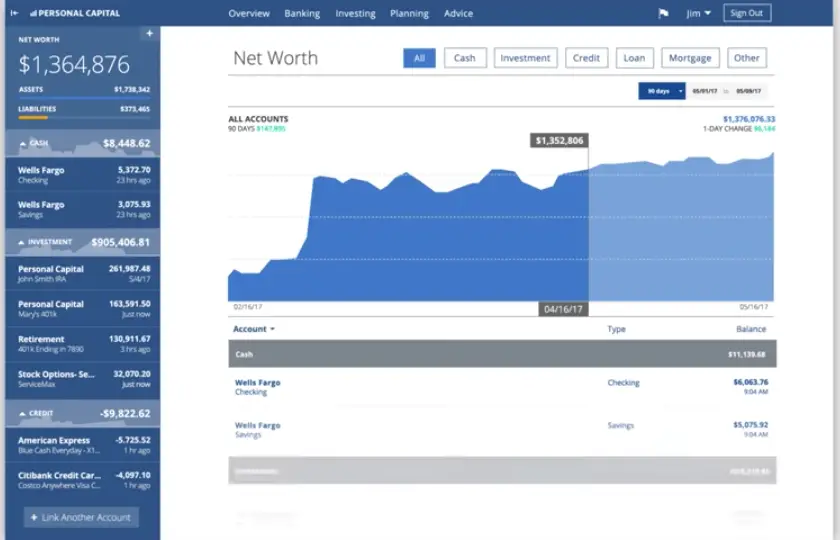

Personal Capital

I’ve heard people describe Personal Capital as Mint on steroids. I’ve used Personal Capital for about a year now. The biggest difference between Mint and Personal Capital is that Mint is focused on your personal finances, but Personal Capital incorporates your investment accounts into the picture.

Why is that important?

One of the best indicators of your financial health, is your net worth.

Net Worth = All your assets (home, savings, car etc.) minus your liabilities (debt).

Personal Capital will look at all your accounts – assets and liabilities, and give you a snapshot of your net worth each time you log in. So if you see it’s gone down a bit, you can quickly see why. Or if it’s gone up, it’s nice to see how your efforts are paying off.

A few other nice features:

- It’ll project the future size of your savings using either your current savings rate or a hypothetical rate.

- It’ll examine the fees you pay in your retirement account, and let you know if you’re paying too much.

So where Mint is focused more on getting your personal finances on track, Personal Capital focuses less on teaching basic financial skills, and more on managing the money you have.

Personal Capital is secure. They’re regulated by the SEC and meet the same cybersecurity regulations your bank does. Personal Capital doesn’t have access to move your money, only to view the amounts and give you an overall picture of your finances. And it doesn’t store your account information in plain text. It uses a one-way encryption token to gain access to your account.

Cost: Personal Capital is FREE.

You do have the option of paying for a financial advisor, but the free version is a full-featured and powerful app. The fee for an advisor to manage under one million dollars would be 0.89%. But again, that’s optional. I use the free version.

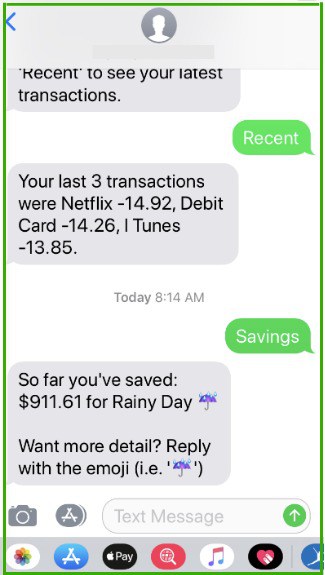

Digit

Digit isn’t a budgeting app, but it can help your budget work. Digit is a simple, yet powerful mobile app for anyone who’s procrastinated about setting up an emergency fund. I’m including it here, because without an emergency fund, it’s very hard to make your budget work.

Remember, budgets are for regular, predictable expenses. Not emergencies.

Without a separate emergency fund, you’d need to always keep a large buffer in your checking account. That defeats the purpose of using a budget, because you’re always playing a guessing game.

Digit is a simple, mobile app that connects to your checking account. It monitors your spending and deposits and ‘learns’ your patterns. Every few days it’ll move a small amount from checking into your Digit account.

I started using Digit in early 2017, and it’s been a lifesaver. So far, it’s paid for 4 unexpected car repairs (one for over $1100).

It can be tough to build an emergency fund, especially if you’re struggling to pay off debt. But that’s exactly why you need an emergency fund. So that you pay cash for emergencies and stop adding to it.

So if you’re a procrastinator like me, you might want to take 5 minutes to install it and try it out for a month or two (it’s free for the first 100 days, then $2.99/month). Then see how much it’s saved for you, and consider how little effort it took.

Here’s my full review if you want to see it in action.

Cost: Digit is FREE for the first 100 days, then they’ll deduct $2.99 per month from your savings.

Note: Most of these budgeting tools are a matter of personal preference. But however you cut it, you really need an emergency fund in order for your budget to work. For me, Digit was a simple way to take a task off my plate and enable me to pay cash for emergencies. And for literally, the price of a coffee.

Final Points

Some people believe that a budget isn’t necessary. That as long as you’re saving money each month, why go to the trouble.

But are you saving?

According to this survey by GoBankingRates, most Americans (57%) have less than $1000 saved. That’s barely enough to cover the average emergency, much less fund your retirement. If you’re lucky to have a very high salary, then maybe you can sock 20% away, live modestly, and feel confident.

But the majority of us aren’t saving anywhere near 20%. And the reason could be, that we just haven’t taken the time to figure out what’s most important to us, what’s not, and only spend on the important stuff.

Whether you make $1000 a month or $10,000 a month, if you don’t know where your money is going, you’re probably living paycheck to paycheck.

The key things to remember are:

- Have a plan – What do you want to do in the next year. And the next 5 years. Write it down.

- Make it simple – the best budgeting method is whatever one you’re comfortable with.

- Be consistent – It’ll probably take several months to recognize problems and make adjustments. Hang in there!

You don’t need an MBA to be successful with your finances. Just learning how to budget your paycheck is the best first step you can make. Once you identify what’s most important to you, and filter out the rest, you should see yourself moving in that direction.

Related: