“This post may contain affiliate links. Please read my disclosure for more info.

Even living paycheck to paycheck, you can still learn how to invest with little money.

Two things stop most of us from investing:

- We believe we don’t make enough money to invest.

- We’re not sure where to invest money to get good returns.

Letting these two mindsets stop us, might be the biggest money mistake we can possibly make.

So today we’ll see where you can start investing as a complete novice, and without a huge amount of money.

Table of Contents

Why You Should Start Investing Now

The biggest reason many of us either aren’t ready to retire, or can’t retire is simple.

We use short-term thinking. In my first salaried job, my thinking was:

“I can’t afford to save. I’m only bringing home a few hundred a week. After rent, my car payment, food and bills, there’s not enough left. Maybe in a couple years when my salary increases.”

Usually, “a couple years” turns into five, or ten, or even twenty.

The biggest factor in accumulating enough money to retire isn’t becoming a money expert, or even making a six-figure salary.

It’s just making a regular investment – early enough – and taking advantage of what Albert Einstein called “the 8th wonder of the world.”

Compound interest.

We’ll describe some good investments for beginners below, but first, check out the example Tony Robbins gives about just how critical it is starting to invest immediately:

Tony is convincing, but let’s clarify it even more. We know James retired with $400,000 and William saved 2.5 million, but what does that really mean? What was their quality of life like?

A pretty widely accepted rule of thumb about retirement nest eggs is that whatever the amount, you can afford to withdraw about 4% of your savings each year without running out of money.

So if James withdraws 4% of his $400,000 each year, he’d be living on only $16,000. Ouch. Most likely, James would still need to work.

William, who invested the same amount as James, but started at 20 rather than 40, retired with 2.5 million dollars. If he withdrew 4% each year, he’d live on $100,000 a year.

So now that we know how critical it is to just get started, let’s answer the question, “How to invest with little money.”

Good Investments for Beginners With Little Money

Now that we have a sense of urgency, we need to know two things:

- Where to invest money to get good returns.

- Exactly which investment platforms will enable us to start with a small amount of money.

Use Acorns to Invest Your Spare Change

I’ll mention Acorns first because virtually anyone who uses a debit or credit card can use it. The concept is simple. Whenever you make a purchase with your debit or credit card, it’ll round up the amount to the nearest dollar and invest that amount in an FDIC insured account.

So you’re not investing huge amounts, but Acorns is a great way to trickle money into an emergency fund, or to build savings to fund a larger investment.

I remember the days of spending mostly cash, and emptying my pocket change into a jar each night. When I’d finally get around to cashing it in, I’d be surprised at the amount. So why not just automate that process?

Acorns checks off two needs:

- It’s a great way to get started investing with little money because you don’t need to actually budget money for it.

- You don’t need to know how to invest money. Acorns will ask you simple questions about your stage of life. And depending on your answers, it’ll invest your money in one of five different investment portfolios.

Fees – If you’re aged 23 or younger Acorns is free for up to four years. If you’re 24 or older, you’ll pay $1 per month, deducted from your account for their basic plan. But I look at it this way. If I see that I’ve saved $30 with virtually no effort, then that $1 was worth it.

Summary – Acorns is one of the easiest ways to start saving money. The fact that you’re saving spare change means you won’t see the same growth as some methods below, but it’s a low-cost and virtually painless way to build savings.

Learn more about Acorns.

RELATED: Values Based Budget: How to Manage Your Money AND Do Things You Love

Take Full Advantage of Your Employers Savings Program

We’ve got to mention your employer’s saving program, because it has one benefit you won’t see anywhere else – the employer contribution.

It’s pretty common for an employer to kick in .50 on each dollar you invest, up to a certain percentage. For example, my last employer contributed .50 for every dollar I saved, up to 6%. So if I contributed 6%, they’d contribute another 3%.

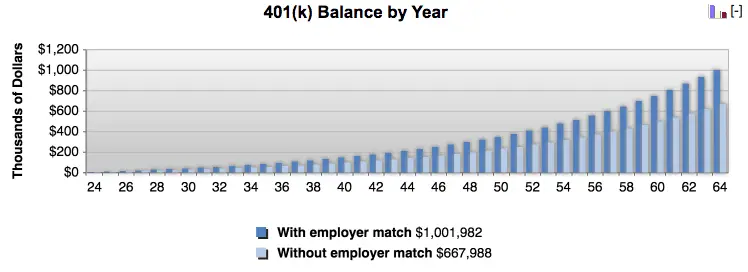

There’s no other investment that’ll yield an immediate 50% right off the bat. In fact, here’s an example of how the employer contribution can add up.

You start a job at age 24 with an annual salary of $50,000 and you elect to save 6% of your gross salary each week. So you’re saving about $58 each week. Let’s say it earns 7% interest.

You’d probably raise your savings contribution as your salary increased, but for now, we’ll leave it at 6% to see that over time, your employer’s contribution has boosted your account by over $300,000.

Like the example above where I “couldn’t afford” to save at the beginning of my career… not joining an employee savings plan means leaving thousands of dollars on the table.

The beauty of employer sponsored plans is that once you join – even with a small amount, it’s a painless way to save, inching it up a little each year.

If you’re considering how to invest with small amounts of money, your employer’s savings program is a perk you don’t want to pass up.

Robo Advisors are Good Investments for Beginners

Let’s say you have $50 or $100 to spare, and you want to use it to start your investment journey. With that amount, you’d have a hard time finding a human advisor to help you.

Robo advisors were introduced in 2008 exactly for this purpose – to help people get started investing with little money.

- They feature a very low, or sometimes no minimum investment.

- They’re perfect for inexperienced investors, because they’ll select an appropriate portfolio depending on your personal situation.

Three of the most popular Robo Advisors are Betterment, Wealthfront and M1. They each offer low-cost, diversified ETF portfolios, automatic rebalancing, and low ongoing management fees.

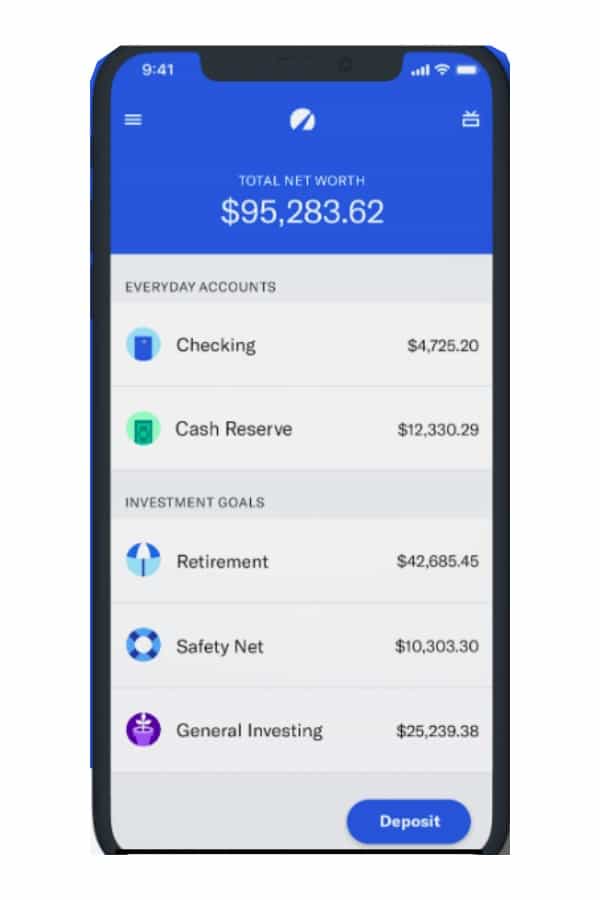

Betterment - Low-cost investing with built-in coaching

Betterment is the most popular Robo Advisor, with over 15 billion in investments and over 400,000 customers.

The simple signup process guides you through questions like your age and income.

And depending on your answers, Betterment will suggest an appropriate investment mix.

It’ll help you to set savings goals that match your personal goals.

Betterment will even coach you to establish target dates, and their simple graphs will let you know immediately if you’re on track.

If you need assistance, Betterment has an online chat feature accessible via the website or the mobile app. Or their direct customer service is available Monday through Friday from 9 AM to 6 PM EST, and 11 AM to 6 PM on weekends.

Fees – Betterment offers two options – Their Digital Plan has a zero minimum balance and an annual fee of 0.25%. Their Premium Plan has a minimum balance of $100,000 and a 0.40% annual fee, but also provides human, rather than online support.

Best For – If you dread the idea of researching different ways to invest your money, then Betterment is a great option. It’ll automatically spread your investment among various stocks and bonds based on your answers to simple questions.

It’s very easy to use, and no minimum investment means you can setup an account today.

Learn More About Betterment

Wealthfront

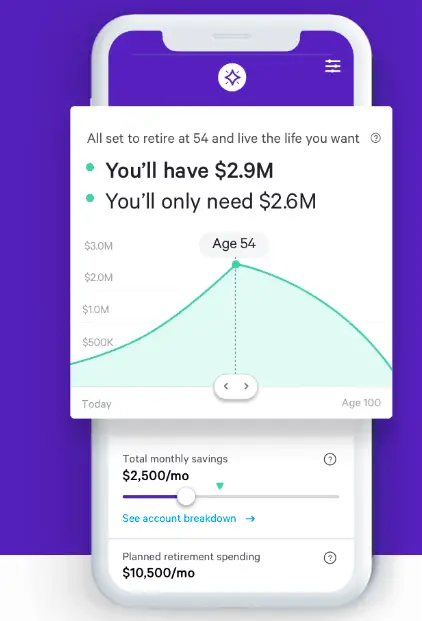

Another Robo Advisor, Wealthfront, was launched in 2011 and currently manages 11 billion in assets. Like Betterment, Wealthfront has a simple setup where they’ll ask you a series of questions. And from your answers, they’ll create an automated investment portfolio tailored to your goals and your risk tolerance.

As simple as Wealthfront is to use, it’s got sophisticated tools that’ll help you not only to save for retirement, but setup and manage other goals.

Things like buying a house, or funding a 529 account to save for college. It’ll track your progress and let you know if you’re falling off track.

Wealthfront will periodically rebalance your portfolio, but one option it doesn’t offer, is the ability to purchase fractional shares.

Purchasing fractional shares means the ability to purchase a fraction of a share of a particular stock when the stock price is higher than your contribution amount. For instance, Tesla is currently trading at $424 per share. If I’m investing $100 a month, my $100 could buy fractions of a share so my money starts working immediately.

Wealthfront can run simple scenarios to predict any what ifs you might be considering, and if you need help, their automated financial planning services are simple to use.

Fees – Wealthfront charges the same 0.25% annual fee as Betterment, but they do require a $500 minimum investment.

Best For – Wealthfront’s appearance may not look as slick as Betterment, but it’s powered with sophisticated algorithms that can be a big help with financial planning. It’ll help you with various projections like increasing your savings, decreasing debt or adjusting your retirement age.

They’ve also recently introduced a pretty cool college planning feature that connects with any college in the U.S. and can assist with your savings plan.

Learn more about Wealthfront.

M1 - A Robo Advisor That Makes Investing Easy as Pie

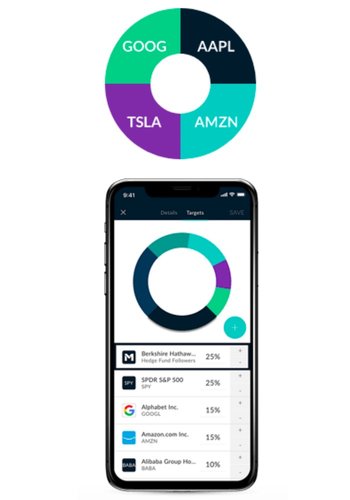

M1 is also a popular Robo Advisor that offers fours types of investment accounts – Individual, Joint, Retirement, or Trust.

From there, M1’s intuitive wizard will ask questions about your life, and based on your answers, will help you to build a portfolio.

M1 uses a pie-based interface so it’s easy to see exactly where your money will be invested. And as time passes, you can select pieces of the pie to check their performance.

You can create a pie that includes a group of specific stocks, like Apple, Google or Tesla for instance, or you can create a custom pie that includes various stocks of a specific industry.

Like Betterment, M1 enables you to own stocks and ETFs (Exchange Traded Funds), regardless of share price, with fractional shares.

The ability to buy fractional shares is a nice feature for investors making small contributions, but want to invest in higher priced stocks.

You can opt to automate your contributions with investing schedules if you want, and M1 will also rebalance your portfolio as needed.

Fees – M1 charges no commissions or management fees, and their minimum starting balance is just $100.

Best For – M1 is also a great choice if you’re looking for guidance on the appropriate portfolio, given your life stage. It’s got a simple interface, allows you to customize your views, and also offers fractional shares.

Both Investopedia and GoBankingRates rated M1 as one of the top investment apps.

How to Invest Money in Real Estate Through Crowd Funding

If you’re starting to invest with little money to spare, then real estate may seem out of the question. But crowd funded platforms like Fundrise can put it within reach – without the headaches of being a landlord.

Fundrise does have a minimum investment of $500, but even if you don’t have lot of money to spare, an app like Digit can help you to easily accumulate that within a few months.

Fundrise will pool your money with other investors in order to make it affordable to everyone. Whatever profits are earned would be split among the investors.

They’ve been around since 2012, and one reason they’ve become popular is that it enables unaccredited investors to invest in real estate.

An “accreditied investor” is:

- Someone with an individual income of $200,000 or a combined $300,000 in income if married.

- Having a net worth exceeding $1,000,000 (individually or combined), which excludes your primary residence.

Most of us don’t meet the mark of an accredited investor, so Fundrise is a great way to squeeze your foot in the door of real estate investing.

There are a few different tiers available. For the minimum investment of $500, you’d be selecting the starter portfolio, which invests in a diversified group of properties.

Or for an investment of $1000, you can select one of three plans – supplemental income, long-term growth, or balanced.

Fundrise has a historical performance between 8.7-12.4%. Their annual fee is 1%.

Learn more about Fundrise.

Lend Money to Others Through Peer to Peer Lending

Peer to peer lending has grown in popularity in the last several years, so it’s worth a mention, but with one caveat – it’s a riskier investment than putting your money into an FDIC insured account.

Peer to peer lending enables borrowers to get loans without using a bank. Similar to a Go Fund Me page, borrowers can get loans from other people.

And investors can earn money from the interest charged on their loans.

You can lessen your investment risk by lending lots of smaller amounts, like $25 to $50 and depending on your results, increase your investment.

Overall, the advantages of peer to peer lending are:

- A low minimum investment to get started.

- A potential for good returns.

And the possible downsides are:

- They’re riskier.

- You’ll need to investigate exactly which loans you want to invest in.

Two of the more popular peer to peer lending platforms are Prosper and Lending Club.

Final Points

If you haven’t started investing yet, then the biggest takeaway here should be to just get started.

You don’t need to be a financial expert, nor do you need a bundle of money to start investing.

With finances as well as with our personal life, it’s not big, bold moves that create the most improvement.

We tend to celebrate a job promotion or a bonus. Or we think exchanging more hours for more money will have a big impact.

When really, it’s the small, 1% improvements in our habits that over time, have the most dramatic effect on the trajectory of our life.

Starting a systematic program of regular investments – before our car payment, our vacation and even our rent – will have the biggest impact on the last third of your life.

How about you?

Are you considering starting an investment program, or have you invested using any of the platforms here?