“This post may contain affiliate links. Please read my disclosure for more info.

When it comes to your finances, it’s not big wins, or occasional mistakes that have the most impact on your life. It’s the overall trajectory. It’s whether you can maintain a gradual upward tick in your net worth each month.

When it comes to your finances, it’s not big wins, or occasional mistakes that have the most impact on your life. It’s the overall trajectory. It’s whether you can maintain a gradual upward tick in your net worth each month.

But how do you know that? Without a paid financial coach, it’d be up to you to go through every one of your accounts each month, and figure out if you’re trending up, down, or just treading water.

Like anything else, the information is available. But gathering it into a format that immediately puts your whole financial situation into focus is something that used to cost a lot – in either time or money.

Enter Bill Harris.

Formerly a CEO of both Intuit and PayPal, he recognized this as the biggest money challenge most people have – just not having a quick way to see your entire financial status as a whole.

So his aim with Personal Capital was to provide a free tool that’ll do exactly that. Most times, the phrase ‘free app‘ means a bare-bones utility that skims the surface, then shows you the more “full-featured” version that you can pay for.

Not so with Personal Capital. They do offer paid advisors, but their free app gives you an insight on your overall finances like you’ve never had.

Personal Capital Review – The 30,000 foot View

First, what is Personal Capital?

Personal Capital is a free app that enables you to see, on one screen, an aggregate view of every one of your accounts.

Think about that for a second.

Let’s say you have a checking account with one bank, and a 401k through your employer, invested at another institution. You have a few mutual funds somewhere else.

And maybe you have a mortgage, several credit cards, and a personal loan or car payment.

So how are you really doing financially?

You could spend your Saturday morning sorting through nine different statements to determine whether your overall trajectory is headed up or down this month. Or you could get the same info in Personal Capital in just a couple minutes and get on with your day.

Or if you did want to dig in a little more, you’d be able to see things like,

- What if I were to pay off that $5000 in bills and increase my 401k contribution by another 4%?

- Is my retirement account invested in the right things, given my situation?

- Am I paying too much in fees?

- What categories of my budget am I spending more on, compared to last year?

7 reasons to consider using Personal Capital:

1. It’s Easy to Use

Finding a less time-consuming method to track my money is what finally made me start actively managing it. Before using Personal Capital, “being on top of my finances” meant making sure I had enough in my checking account to meet this month’s bills.

I’d occasionally peek at my 401k, but never really took the time to log into every account and track my net worth on a month to month basis. And checking your savings while ignoring debt and other assets isn’t really being on top of things.

What also hooked me, was how motivating it is to see your progress anytime you want – not by flipping through multiple accounts for an hour – but just by checking one app.

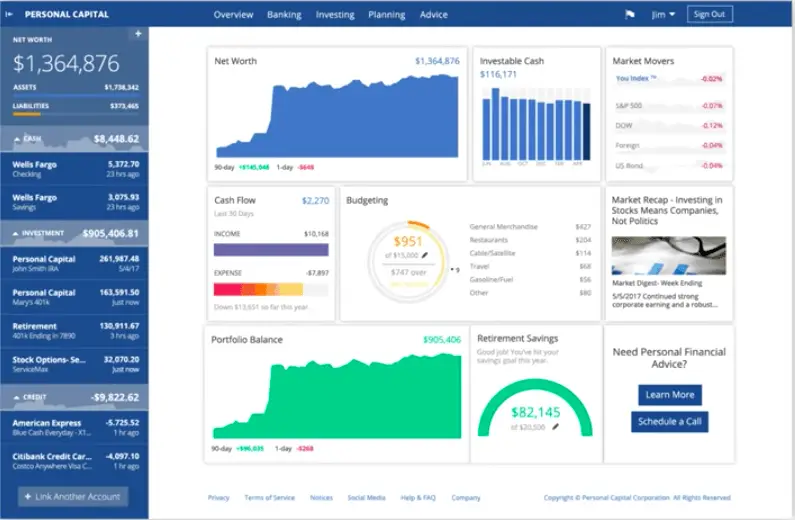

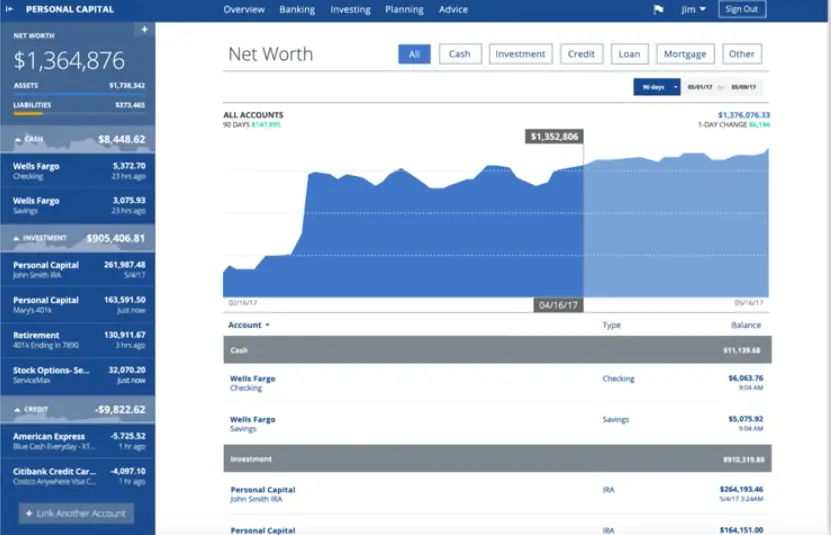

Here’s what the typical dashboard looks like when you log in:

2. It’s the Easiest Way to Track Your Net Worth

Just like your credit score is a quick snapshot that creditors use to gauge your performance, your net worth is the quickest way for you to see your progress. But when you have to manually gather multiple account balances and enter them into an Excel spreadsheet, many people (like me) don’t do it. Personal Capital will automatically calculate your net worth when you log in. It’ll change month to month, and you need to know why.

Here’s what the net worth display looks like:

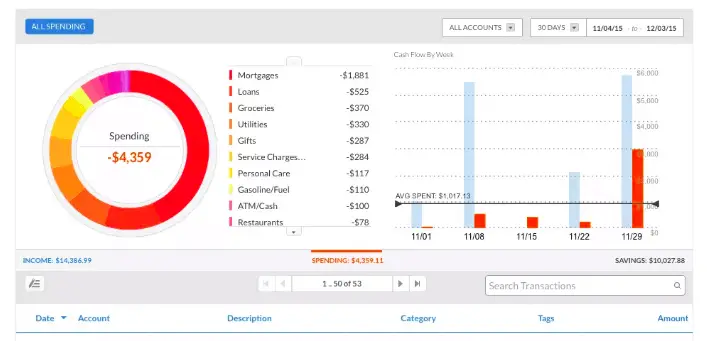

3. It’s a simple way to track your budget

Regardless of your income, spending less than you make and knowing where it’s all going is the bottom line.

Once you enter your account into Personal Capital budgeting it’ll show you right away where every penny is going. Seeing it all categorized makes it easy to determine what category to zero in on. Are you spending too much on food, ATM withdrawals, entertainment, transportation?

They’ve listened to customer requests, and last year, added the ability to add your own categories. I was able to add things like kid’s sports fees, and haircuts. One thing I like, is that if I’m out somewhere and considering a purchase, I can pull out my phone and see immediately how much I’ve already spent in that category.

Here’s what the budgeting view looks like:

4. It helps you balance your investments

I know, many people’s eyes begin to glaze over when you talk about “balancing your portfolio”. But things change. We get older, we go through various life events, and the market changes. So we want the right balance in our portfolio, given our personal situation.

Personal Capital will see imbalances and help you to correct them so you’re not guessing anymore.

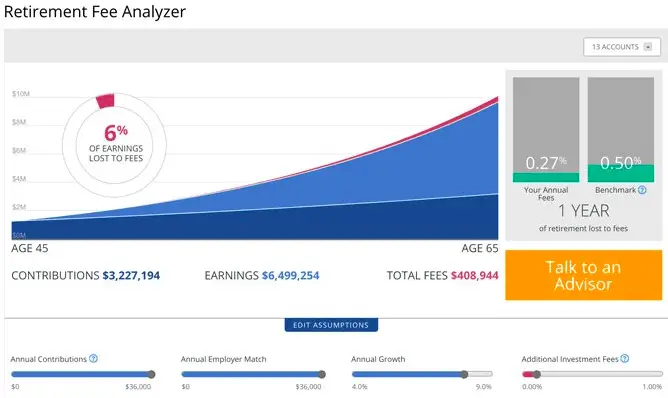

5. You’ll know if you’re being overcharged in fees

Whether someone’s actively managing your money, or you keep an eye on it and make changes, you’re paying fees for any change. And how do you really know whether you’re paying too much? Personal Capital’s fee analyzer is an easy to use tool that’ll spot fees that are larger than they should be and let you know what a reasonable fee would be. Being able to correct these can save literally thousands of dollars over several years.

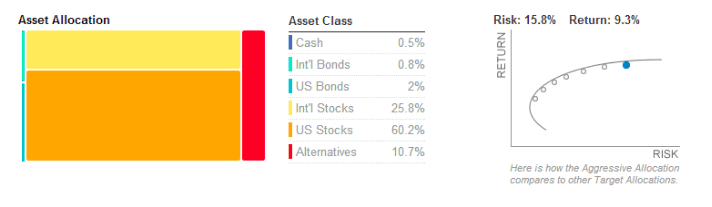

6. It constantly compares your allocation to your risk tolerance

Personal Capital’s Efficient Frontier Curve is a feature that compares your risk tolerance to your current asset allocation, and plots you on a curve. If you’re above or below the curve, you can adjust things accordingly.

Here’s a graph of the risk allocation for a typical 30 year old. This one is heavily weighted in stocks.

7. Personal Capital Security

Initially, I was hesitant to put my account information online. Like anyone else, I’m protective of my life savings. But really, every account we have is already online. Our checking account, mortgage, credit cards, loans, and retirement accounts are all accessible online.

The problem is, that it’s difficult to get a holistic view of your money when you need to log in to multiple accounts. Personal Capital enables you to view all your accounts at once, and is just as secure as any of your other accounts.

Here are some of Personal Capital’s security features:

- First, they’re regulated by the SEC and have to meet all of their cybersecurity regulations just like the banks you already use.

- It uses a two factor authentication, and it registers your computer the first time you use it. If you’re using an iPhone you’ll use the fingerprint authentication.

- Personal Capital doesn’t store your account information in plain text. It uses a one-way encryption token to gain access to your account.

- You can’t perform withdrawals or transfers from within Personal Capital. The app read-only because it’s purpose is to view your finances as a whole, and see how you can maximize it’s growth. You’d still make any changes through the specific accounts.

- When you log in, your actual account numbers aren’t displayed anywhere.

Some Background about Personal Capital

Personal Capital is based in San Francisco, and was co-founded by Bill Harris who is currently the CEO. He was previously the CEO of PayPal and Intuit.

The idea of Personal Capital, according to Bill Harris, was to provide both free and paid wealth management products. But he wanted the free version to be a full-featured product that gives the average person the ability to see an overall picture of their money.

When you sign up for the free version, they’ll contact you and offer a free consultation, but there’s no obligation to accept it, and no obligation to pay for anything.

I’ve tried Mint and You Need a Budget, which are more geared to budgeting and month to month finances. But Personal Capital goes much further by including your investments.

Currently, they manage about $6.5 billion dollars in assets, and they track (the free accounts) over $500 billion dollars from over 1.6 million users.

Here’s Bill Harris himself describing how and why Personal Capital was founded:

Final Points

Personal Capital is one of those things I never knew I needed – like a cell phone – until I started using it. I thought my good old Excel spreadsheet was fine.

But honestly, I didn’t update the spreadsheet faithfully. Getting the numbers manually from multiple accounts was time consuming. I had to deal with multiple ID’s and passwords. So, sometimes I’d go months without updating it.

But now, being able to pull out my phone and instantly see the status of my budget, debts and investments is pretty empowering. I’ll see that my accounts and my net worth are what I was expecting, and if not, I’ll know that I should dig in a little more and see why.

The number one reason so many people reach retirement age without enough money, is that they weren’t consistently aware of their overall financial picture. When it comes to money, what you don’t know will hurt you.

Anyone can look at a generic savings calculator and see how a typical account would grow. But seeing your accounts, and how each one is affecting your whole financial picture is a huge part of building enough wealth to walk away from work one day and live comfortably.

I hope this Personal Capital review has been helpful. If you’d like to try it yourself, remember it’s a FREE app, and not only do you not have to give them your credit card number, they’ll give you an introductory bonus of $20 to try it.