“This post may contain affiliate links. Please read my disclosure for more info.

Anyone who’s started a new job has probably wondered what an HSA is at some point. You’re probably inundated with forms to fill out for things like health benefits, savings plans, group insurance… and an HSA.

Anyone who’s started a new job has probably wondered what an HSA is at some point. You’re probably inundated with forms to fill out for things like health benefits, savings plans, group insurance… and an HSA.

So if you’ve wondered, “what is an HSA and why would I need one“, we’ll answer it here.

The short answer is, an HSA, or Health Savings Account is a way your employer can help you to save for medical expenses.

The incentives to join an HSA are:

- Some employers will kick in additional contributions.

- You’ll reduce your taxable income by contributing.

- You’ll always keep the account, even if you leave or retire.

- Having an HSA helps you to maintain a predictable budget.

Not everyone qualifies for an HSA, but read on to see whether you do, and an alternative that’ll also help your bottom line.

Table of Contents

Can an HSA Really Save Money?

We all have those gut punches to the wallet every now and then. The ones where it seems like we’re finally starting to tread water and then…

The car needs brakes, or your clothes dryer dies. Or you need a root canal, or encounter some other medical expense that requires out of pocket money.

You don’t have the cash available, so you need to take it from another expense. Or even worse, you charge it on a credit card. And there we go, back under water again.

Last year, I was hit hard with dental expenses. The year before, my daughter needed braces which meant a big down payment, then monthly installments.

Medical expenses are the leading cause of bankruptcies in the U.S. So the federal government, through tax laws, setup HSA’s (Health Savings Accounts) and FSA’s (Flexible Spending Accounts) to help you pay for them.

If you have health insurance though your employer, there’s a good chance they offer an HSA or an FSA. And since November is open enrollment month, now’s the time to evaluate what you’re paying for and how you can reduce it.

What is an HSA?

An HSA is an account that you can funnel a percentage of your paycheck into so you’ll have money for out of pocket costs. Just like your own emergency fund protects you against sudden car repairs or personal emergencies, having an HSA will protect your budget when you’re hit with medical expenses.

Having a predictable budget with no surprises is a key to moving past paycheck to paycheck life.

Related:

- 7 Simple Tasks That Saved Us $4000 Last Year

- How to Build an Emergency Fund When You Don’t Have the Money

- 28 Work From Home Jobs That’ll Make You Ditch Your Commute

- 7 Free Fitness Apps That’ll Make Your Gym Obsolete

Am I eligible for an HSA?

You’d be eligible for an HSA if:

- You’re a member of a “high-deductible health plan” (below).

- You have no other health insurance other than your high deductible health plan.

- You’re not covered under Medicare.

- You can’t be claimed as a dependent on anyone else’s tax return.

So what exactly is a high-deductible health plan?

For 2020, a HDHP plan would have a minimum deductible of $1400 for individuals or $2800 for families. In other words, you’d be responsible to pay for medical expenses out of your own pocket until you’ve paid at least that amount.

A lot of families probably fall into this group:

You’re all generally pretty healthy. You have a well visit here and there, or a visit to the urgent care office for a sinus infection or the flu. But you end up paying out of pocket for everything because you haven’t met your huge deductible.

So for the most part, you’re paying for insurance you can’t even take advantage of.

What Would I Use an HSA for?

You can use your HSA for “qualified medical expenses” which would be things like dental or vision care, prescriptions, co-pays, visits to chiropractors, x-rays, lab tests, physical therapy, and even deductibles.

So if you have kids and find yourself at the pediatrician a lot, or buying prescriptions, contacts, or paying a lot of copays, an HSA will help you to maintain predictable expenses each month.

Even if your family is pretty healthy now, there’s no getting around it – sooner or later you’ll have some kind of unexpected health or medical expenses.

So having some money drip into your account with each paycheck is a great way to protect your budget.

A few more perks of an HSA

- You contribute pretax money to an HSA, so your contribution lowers your taxable income.

- Contributions made to an HSA are 100% tax deductible, and any interest earned in the account is tax-free.

- Those two reasons are why you should consider using an HSA and save your personal emergency fund for non-medical stuff.

- You don’t use it or lose it this year. Whatever HSA money you don’t use this year, rolls over to next year. In fact, that’s a big misunderstanding. One survey found that 40% of Americans think you need to use all of your HSA money in the current year. You not only carry it over from year to year while you work, but even into retirement.

- Some employers will kick in additional money to an HSA for you. That’s FREE money!

- If you change jobs, your HSA money goes with you.

How much can I contribute?

For 2020, you can contribute up to $3,550 as an individual, or $7100 for a family. If you’re 55 or older you can kick in an extra $1,000 as a “catch up” contribution.

Keep in mind, that if your employer is contributing to your HSA, then their contribution is counted in that amount. So for example, if you’re single and want to contribute the max of $3550 and your employer is contributing $1000, you’d be able to contribute $2550.

I’m not eligible for an HSA. Now What?

If you’re not eligible for an HSA, there’s still an option you might want to consider – an FSA, or Flexible Spending Account.

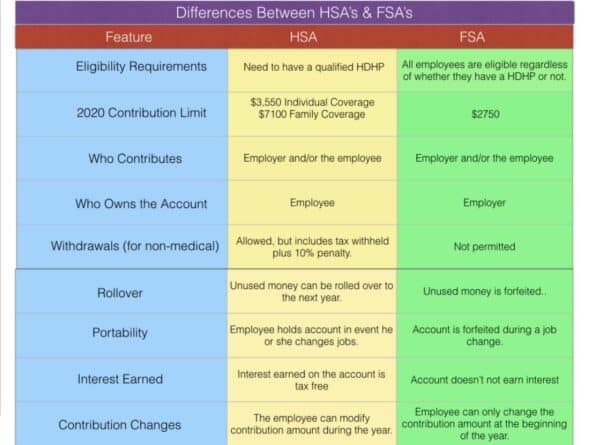

The Difference between an HSA and an FSA

- An FSA doesn’t have as strict qualifying requirements as an HSA. Many more people can open an FSA, in fact, most health plans offer them.

- With an HSA, you can change your contribution amount whenever you want. But with an FSA, you can only set your monthly contribution amount once a year during the renewal period. But here’s a nice feature of the FSA – as soon as you select the yearly amount, that entire amount is available to you whenever you need it.

- Your money in an HSA rolls over from year to year, but money in an FSA has to be used that calendar year. You “use it or lose it”, then start fresh in the new year.

Although you lose whatever money remains in your FSA at the end of the year, there’s a way you can deal with that. Think about the past year. Take a few minutes to estimate what you spend on health and medical expenses.

It’s impossible to estimate exactly, but if you get to December and have money left in your account, use it to stock up on products you’ll use in the following year.

What Can You Buy With Your FSA Funds?

Like the name implies, an FSA is really flexible about your spending options. Thousands of over the counter products can be purchased with the money from your FSA.

Anything from adult or prenatal vitamins, skin creams, allergy or cold medicine, acne medicine, sunscreen, pregnancy tests, thermometers, first aid supplies, medical monitoring and testing devices and a lot more.

Final Points

Earning a high salary is nice, but building wealth has more to do with being intentional with the money you have. Things like using a budget to track spending, and a building a dedicated emergency fund that’ll make your budget predictable.

An HSA or an FSA will help in the same way, so you can plan your life and have no surprises.

Health and medical events can be stressful enough, but having an HSA or an FSA can at least help to relieve the financial sting.