“This post may contain affiliate links. Please read my disclosure for more info.

Managing your money is like exercising. It’s important, but it can be tough to do consistently.

Managing your money is like exercising. It’s important, but it can be tough to do consistently.

We’re faced with dozens of less important, but urgent decisions each day…

- Should I work out at home or at the gym?

- What’s for dinner?

- Should I trade in my iPhone or keep it?

So it’s easy to punt on the more important ones. The ones we think will require more time and attention.

Sometimes putting things into place to help us stay on course with long term goals, can help us to be more present and less stressed in the short-term.

Like Tim Ferriss says about to-do lists… “what’s the one thing on your list, that if done, will make the other things easier?”

So in that spirit, here are three things you can put into place in minutes, that’ll make managing your money easier.

Some More Smart Ways to Keep More of Your Money:

- 7 Simple Tasks That Kept $4000 More in Our Pocket Last Year

- How to Work Out at Home, Save Money, and Finally Get in Shape

- 20 Ways to Save Money This Year – You Can Easily Save $3000

- How to Build Your Own Profitable Blog

Table of Contents

1. Use a Simple Tool to Track Your Money and Net Worth Easily

It’s not enough to know that you’re able to pay the bills each month.

When you pull out of your driveway, your objective isn’t to drive each mile successfully. You want to know things like: Where am I going? Am I taking the best route? Do I have enough gas? What time will I get there?

But most people spend their financial life driving blindly. We know that if nothing changes, we’ll pay the bills next month too. And next year.

But what year will we be able to stop working? Or will we ever be able to, given our savings rate? What if we’re laid off next year. Would we be ok for awhile?

Regardless of what your salary is, it’s pretty hard to get where you want to be in life without knowing things like:

- Where your money is going each month.

- Where you’re leaking money.

- How much you’re saving.

- How much debt you have, and how can you eliminate it quicker.

- Projections – What would happen by tweaking your savings.

- Your net worth – the most important indicator of your financial health.

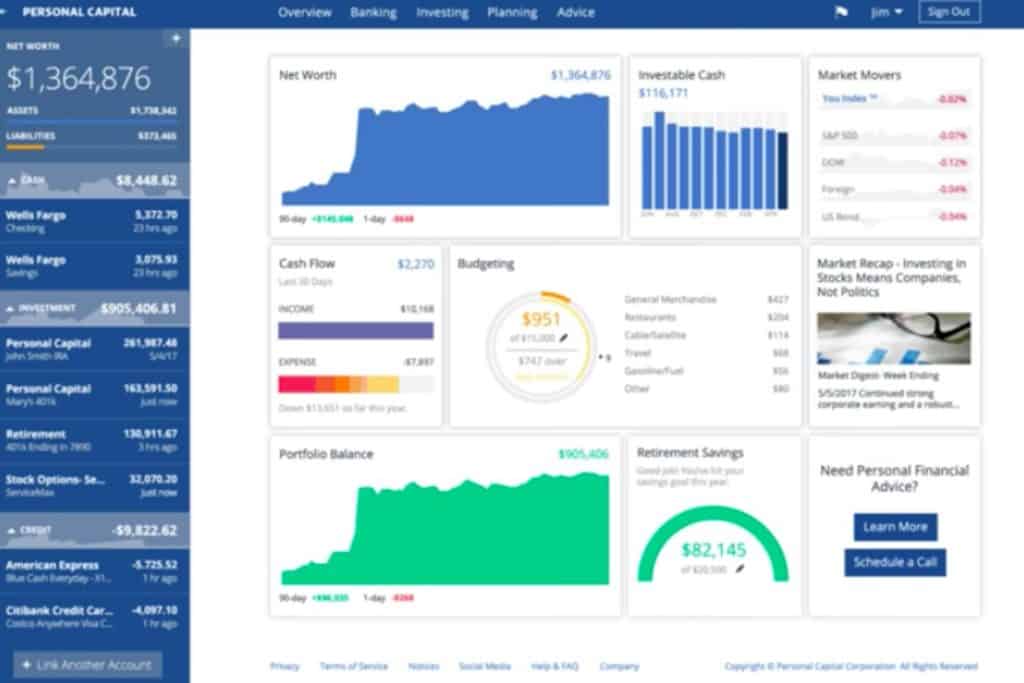

The easiest way I’ve found to keep an eye on everything is through the free app Personal Capital. Whether you’re on your lunch break, or on the couch at night, you can glance at the dashboard and get a quick overview of every one of your accounts, under one umbrella.

Or when you have more time at home, you can dig deeper and estimate how certain changes might affect you. You can see if the investment fees you’re paying are too high, or estimate when you’ll be debt free.

The purpose of Personal Capital isn’t to move your money around, in fact you can’t. But seeing an aggregate view of everything from your checking account, to savings, investments, loans and credit cards, and how they all affect the big picture is a great motivator to stay on course.

Whether you’re just getting started with budgeting and saving, or you’re a seasoned investor, Personal Capital is a simple interface with as many tools as you’ll need.

I’m still surprised that Personal Capital is completely free. It’s such a stress reducer knowing that I’m okay this month, but I also have a good idea of how I’ll be 15 years from now.

2. Build Your Emergency Fund on Auto Pilot

You know why most budgets fail?

Suppose you spent a few hours documenting your expenses and set limits on things like food, clothes and spending money? You’ve managed to discipline yourself for a few months and are feeling good about finally being able to meet your bills.

And then Bam! Your car needs an $800 repair. It’s got to come from somewhere, and if you don’t have the cash, it’ll probably be charged on a credit card.

There goes your budget. Now you have another monthly payment. And it’s probably going to happen again before you pay this one off.

The only way to get out of paycheck to paycheck mode is to have a predictable budget each month. And the only way to do that, is to have cash set aside for emergencies.

Most people living paycheck to paycheck will put off building an emergency fund because they’re in this exact situation. They just don’t have the money to spare.

The best way I’ve found to set cash aside in small amounts is by using Digit.

Digit eliminates 2 of the roadblocks that prevent most people from building an emergency fund.

- Not having $25-$50 each week to set aside.

- Not having the discipline to actually do it regularly.

Digit is a free, simple to use app that’ll monitor your checking account and ‘learn’ your spending patterns. It’ll open an FDIC insured emergency account for you, and will only move small amounts into your fund when it sees you have the money.

You’ll get a text every morning with your checking balance, showing the amount its changed from yesterday. You can reply with “recent” to see what transactions caused your balance to change, “pause” to put a hold on your deposits, “savings”, to see your emergency fund balance, or any number of other inquiries.

Digit is free for the first 100 days, then they’ll charge $2.99 per month. If you’re wondering whether that’s worth it, just think about your next emergency. Where’s the money gonna come from?

I recently had an $1100 auto repair that barely affected my checking account, and didn’t add a dime to any credit card debt.

Just like working out or dieting, the key to success isn’t running a marathon or starving yourself. It’s consistency over the long haul. And for the price of one coffee each month, Digit provides that.

Here’s my Digit review if you want to see it in action.

3. Know Your Credit Score Instantly

Tracking your net worth is the easiest way for you to see if you’re making progress financially. But your credit score is how other people view your financial health.

Who uses your credit report?

- Banks where you’re applying for a loan.

- Automobile dealers

- Utility companies

- Government agencies

- Even potential employers in some states can pull a modified form of your credit report.

And a potential employer doesn’t have to say it’s your poor credit history that influenced their decision. They can cite any reason.

Or a car dealer can say, “Sorry, we can’t give you the 1.9% financing due to your credit score. The best we can do is 5.9%.” Which just added a few thousand dollars to your loan. But if you already knew your credit score is 800, you’d either get the lower rate, or walk away knowing the guy down the street will give it to you.

Not knowing your score ahead of time puts you at a disadvantage. But having that information before dealing with anyone helps you to get an approval and pay a fair price.

So how do you get it?

You can get a free summary of your payment history once a year from Annual Credit Report. But their summary won’t include your credit score unless you pay them. And the score is what creditors use.

I use Credit Sesame, because it’s free to sign up, they’ll show your creditors, your payment history, and they’ll give you your credit score for free. They also offer free credit monitoring, which you can opt for or decline.

It’s pretty eye-opening to see the simple ways our score is lowered that we might not ordinarily see, but can easily be corrected.

- You can see if you’re over-extended (using over 30% of your available credit).

- You can see accounts you may not have realized were still open, and close them.

- You can see possible errors, or late payments and follow up to correct them.

- You can see how carrying extra debt and maybe missing a payment here and there is hurting you.

Then after you’ve made corrections, check your score again a month or two later – for free. It’s safe to periodically re-check your score through Credit Sesame without negatively affecting it. They do what’s called a “soft inquiry” so your score isn’t affected.

Final Points

So there are 3 easy but powerful moves you can make in under an hour. Using Personal Capital alone, is almost like having a personal finance coach in your pocket. Having all that data in an easy to use app is a perfect way to get both a macro and a micro view of your finances. For free.

Building your emergency fund is key to getting out of paycheck to paycheck mode. And if you’re a procrastinator or have a lot on your plate, Digit will ensure your account is growing each week when you have more important things to do. Your budget will become predictable, so you’ll be able to focus on eliminating debt or saving.

Staying on top of your credit score will help throughout your life. You’ll see how potential creditors view you, and when you notice a change, you’ll be able to see the reason for it right away. And knowing your credit score is a great motivator to protect it.

The meaning of life is up for debate, but I’m pretty sure our purpose isn’t to function as a bill-paying robot. You probably want to do things and go places that’ll require money to get there.

It boils down to execution. Doing the small things over and over, day after day, that keep you moving. And if there’s a couple things you can do that’ll cross several things off your to-do list, it makes sense.

What are your goals? To retire at a certain age, to travel, start a side business?